A collaboration between Sompo, the second-largest insurance company in Japan, and Israeli startup GeoX, was announced on Wednesday. Through the partnership, GeoX will provide their patented technology based on artificial intelligence (AI) to analyze 3D aerial images of millions of Japanese buildings and automatically assess their real estate assets and insurance risks.

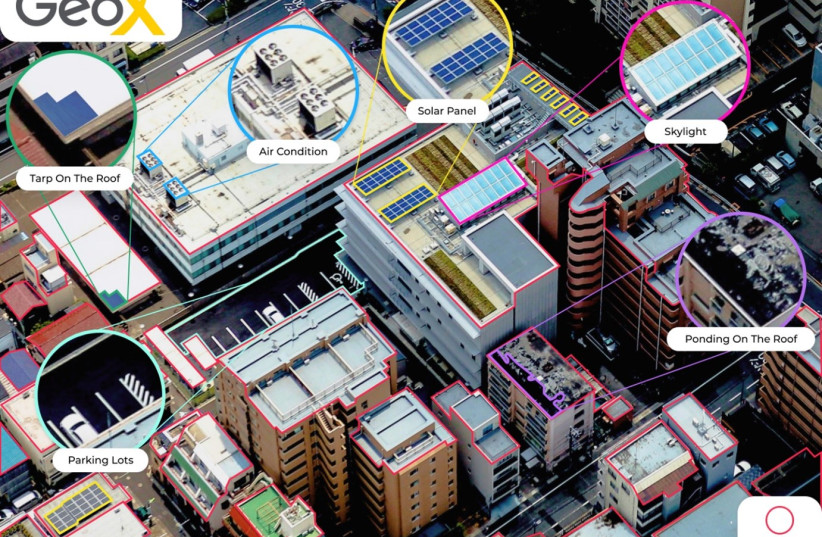

Founded in 2018, GeoX provides a slew of relevant data, including the size of the building’s roof, the type of roof, its condition, its slope, and more, which can contribute greatly to the property insurance sector. The technology is designed to assist customers in making the underwriting process more efficient for damage to property caused by natural disasters.

The GeoX technology is in high demand due to climate change, which can lead to severe property damage. Any sort of natural disaster, be it flooding, hurricanes, or even extreme heatwaves can harm properties. According to GeoX, the amount of such natural disasters has increased by five-fold over the past 40 years and has had an economic cost of $3.64 trillion.

These kinds of incidents are costly for insurance companies, which in 2020 alone, had to pay out $100 billion because of climate change-related damages. This is a 40% increase from the average over the past 100 years.

Furthermore, the COVID-19 pandemic, and its mandatory social distancing mandates, has forced insurance companies to use drones or pictures taken by customers to do their assessments, which can be more complex.

GeoX co-founder and CEO Izik Lavy noted that the collaboration will make this process smoother for Sompo.

“Our technology saves Sompo the need to send surveys to each house during the underwriting process at high cost and even to provide an accurate price assessment automatically to customers, who ultimately benefit from fast service with an accurate cost estimate," Lavy said.

"Not only that, but we also allow the supervision of assets that are already insured and the possibility of examining if there has been a decline in maintenance of the building, which would mean a rise in the risk."