International art collector Jose Mugrabi is among the first investors in the Esh Digital Bank founded by entrepreneur Nir Zuk which just launched.

Maariv learned that Mugrabi was one of the first investors in the bank and was recruited to the project by a former treasury official.

Mugrabi is an international businessman who owns artwork with an estimated value of more than half a billion dollars. He sponsored, among other things, the exhibition of the international artist Jeff Koons that was held two years ago at the Tel Aviv Museum.

His investment in the bank isn't high and is estimated at a few million shekels. Mugrabi decided to invest because he feels that with its technology, the bank will expand its activities and will quickly reach the US.

The main investor in the venture is Nir Zuk, the controlling owner of Palo Alto Networks. The bank's establishment was initiated by the businessman Yuval Aloni, who even managed the project in the first stages until the transfer of management to Kobi Malkin, former CEO of Bank Otsar Ha-Hayal. Aloni recruited Shmuel Hauser, former chairman of the Securities Authority, for the project.

Hauser, who will own a percentage of the bank's shares (allotted to him upon its establishment), received special permission from the Governor to serve as chair of the board of directors.

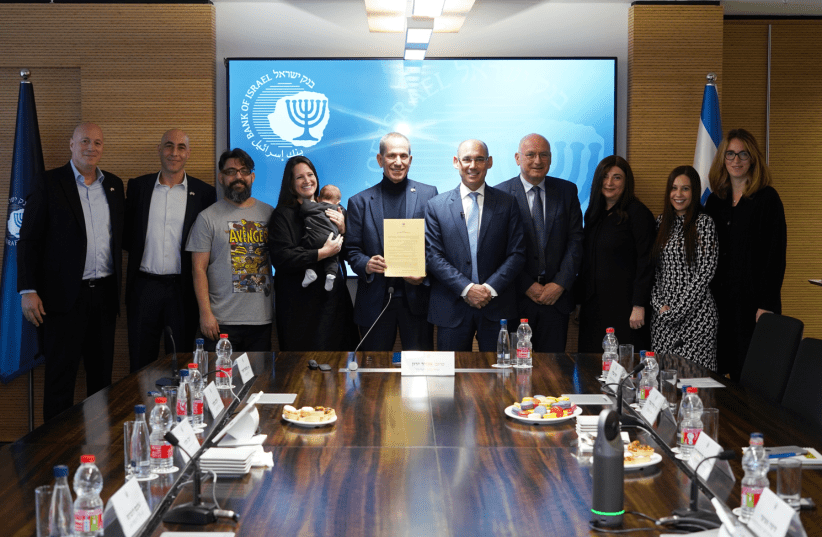

Apart from Hauser, regulators include Prof. Nadine Trachtenberg, former deputy governor of the Bank of Israel, who will serve as deputy chair of the board of directors. As mentioned, the bank will be managed by Malkin. The Governor of the Bank of Israel, Prof. Amir Yaron, and the supervisor of banks, Yair Avidan have granted Esh a conditional license.

New digital bank's features

The bank will offer "checking" accounts and appeal to private, independent and corporate customers with the ability to buy deposit products, loans, payments and credit cards.

Unlike Bank One Zero, which bought the technology for operations from Tata Bank, Esh will operate on the basis of unique cloud-based technology. It's an updated platform to which apps and developments can be added quickly to help customers. If the business model is successful in Israel, there's a plan to operate it abroad as well. The tech allows for a lean and efficient expense structure.

The first product of Esh will be a "checking" account and in the long run, the bank will be able to offer loans at competitive rates. At Esh, like One Zero, there will be no account management fees, no transfer of the existing account or salary will be requested, and products will also include international credit cards.