NEW YORK, Feb 25 - A federal appeals court said the trustee liquidating Bernard Madoff's firm may pursue dozens of lawsuits to recoup funds from Koch Industries Inc, controlled by billionaire brothers Charles and David Koch, and other defendants, including major banks.

Monday's decision by the 2nd U.S. Circuit Court of Appeals in Manhattan overturned November 2016 dismissals by U.S. Bankruptcy Judge Stuart Bernstein in Manhattan.

It gives the trustee Irving Picard a chance to add hundreds of millions of dollars to the $13.36 billion he has recouped for former customers of Bernard L. Madoff Investment Securities LLC.

The trustee has estimated that the customers lost $17.5 billion in Madoff's fraud, which was uncovered in December 2008.

Picard had sued Koch, HSBC Holdings Plc, UBS AG and others in 88 lawsuits to recoup funds traceable to the imprisoned swindler, but which had been sent outside the United States.

The lawsuits targeted foreign entities that had received Madoff-linked money from other foreign transferees, including "feeder funds" that sent client money to Madoff.

Writing for a three-judge panel on Monday, Circuit Judge Richard Wesley said the later transfers qualified as domestic because the money originally came from Madoff's firm.

He said comity, or the need to let other countries enforce their own laws, and the presumption that U.S. bankruptcy law did not reach foreign activity should not block the lawsuits.

"Congress wanted these claims resolved in the United States, rather than through piecemeal proceedings around the world," Wesley wrote.

The defendants had accused Picard of pursuing a "radical expansion of the reach of U.S. law." Their lawyers did not immediately respond to requests for comment.

David Sheehan, a lawyer for Picard, said the decision protects victims of Madoff's Ponzi scheme, and recognizes the "compelling" U.S. interest in letting domestic bankruptcy estates recover fraudulently transferred property.

Sheehan and Picard are partners at the law firm Baker & Hostetler.

Picard had sued Koch to recoup $21.53 million allegedly sent by Madoff to Fairfield Sentry, a British Virgin Islands-based feeder fund, and then to a Koch entity in Great Britain.

The trustee did not allege wrongdoing by Koch, a privately held industrial conglomerate based in Wichita, Kansas.

Charles and David Koch are each worth $51.9 billion, and tied as the world's 10th-richest people, Forbes magazine said.

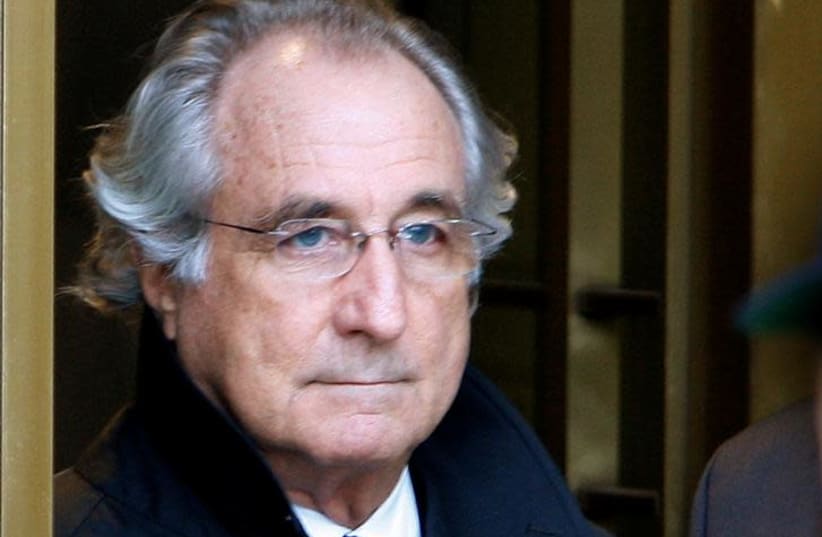

Madoff, 80, is serving a 150-year prison term in a medium-security North Carolina prison.The case is In re: Picard, 2nd U.S. Circuit Court of Appeals, No. 17-2992.