Small business owners deserve a checking account that supports rather than hinders their daily operations. Bluevine Business Checking might be the answer for some.

Founded in 2013, this online banking platform offers a business checking account with unlimited transactions, minimal fees, and a host of other useful features.

In this review, we’ll explore everything Bluevine Business Checking provides for business owners and how it compares to other options. This way, you can decide if it’s the right fit for you.

>> Open Your Bluevine Business Account >>

Bluevine Review – Our Verdict

Bluevine Business Checking is packed with features and has very few fees. Many business checking accounts don't offer interest, or if they do, it's minimal. Bluevine’s competitive interest rate means more earnings for small businesses, especially if you maintain larger balances.

Bluevine doesn't have physical branches, which isn't ideal for those who prefer face-to-face banking. However, with ample options for managing funds through ATMs, cash deposits, and mobile access, you might never need to visit a bank in person. Frequent cash deposits could be less appealing due to the Green Dot cash deposit fee.

Since Bluevine only offers one business checking account, you might need to have accounts at other banks to meet all your business needs. It's often more convenient to have all your bank accounts in one place, potentially with benefits for opening multiple accounts.

Nevertheless, with its numerous advantages and minimal fees, Bluevine Business Checking could be a worthwhile choice despite any inconvenience.

Pros

- No monthly fees and very few additional charges

- No minimum deposit required to open or maintain the account

- Unlimited transactions

- Competitive interest rates

- Check-writing privileges with two free checkbooks

- Wide network of ATMs

- Ability to make cash deposits

Cons

- No savings account option

- No physical branches

- Mobile banking app has lower ratings

- Customer service only available on weekdays

- Fees for cash deposits

Features | |

Monthly Fee | $0 |

Minimum Deposit | $0 |

Overdraft Fees | $0 |

APY | 1.50% on balances up to $100,000 |

Transactions | Unlimited |

Account Types | Business checking and business loans |

Cash Deposits | $4.95 |

ATM Fees | $0 in-network, $2.50 out of network |

Outgoing Wires | $15 |

Bluevine Business Banking at a Glance

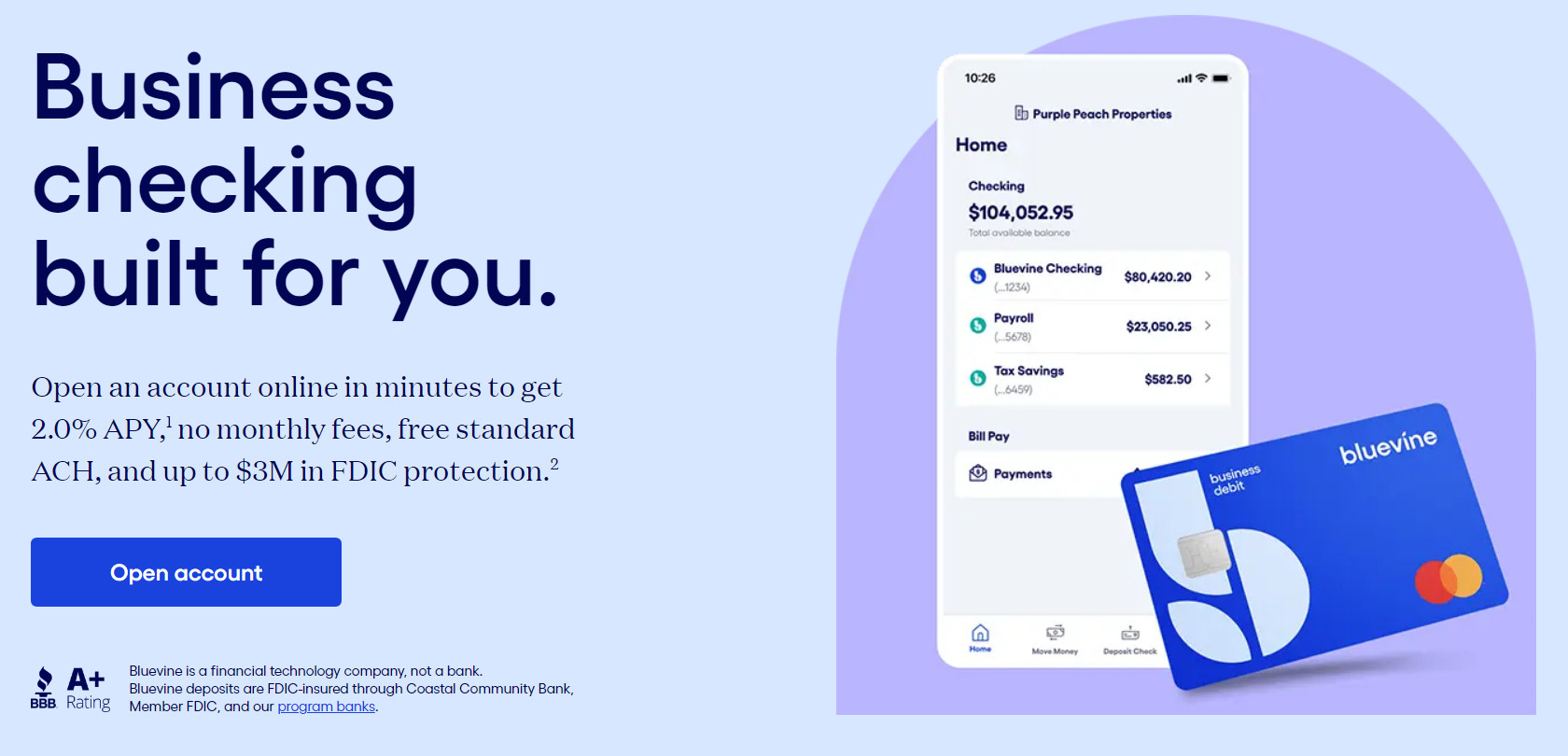

No fees and unlimited transactions are the basics for online business checking accounts, but Bluevine raises the bar with its free, high-yield business account. Bluevine’s account earns 2.00% interest on balances up to $100,000, one of the highest rates for a business checking account. Unlike most online-only accounts, Bluevine allows cash deposits, though there's a fee.

Founded in 2013, Bluevine started offering business checking accounts in 2019. Its banking services are backed by Coastal Community Bank, with FDIC insurance up to $250,000.

>> Join Bluevine Business Checking Account! >>

Which Bluevine Business Checking Is Best For

Bluevine Business Checking is ideal for businesses wanting to keep costs low, make unlimited transactions without worrying about fees, and earn interest on unused funds. If your business doesn't frequently deposit cash and you don’t need in-person banking, Bluevine Business Checking should be on your shortlist.

Bluevine Business Checking can be an excellent choice for businesses looking to minimize costs, make unlimited transactions without worrying about fees, and earn interest on unused capital. If your business doesn’t need frequent cash deposits and you’re not concerned about in-person banking, Bluevine Business Checking is a solid option.

Bluevine Business Checking is Ideal for Small Business Owners Who:

- Want a free business checking account that earns interest

- Prefer managing their finances online

- Only need one business debit card

- Don’t need access to a physical branch

Bluevine Business Checking Fees

Bank fees can be a hassle, especially when trying to run a business profitably. Bluevine helps by eliminating many common fees and minimums, offering:

- No monthly service fee

- No minimum balance requirement

- No minimum deposit requirement

- No ATM fees at over 37,000 MoneyPass ATMs nationwide

- No non-sufficient fund fees

The account allows unlimited transactions each month with no fees. Although Bluevine doesn’t offer other accounts, you can easily transfer funds to and from your Bluevine account and accounts at other banks.

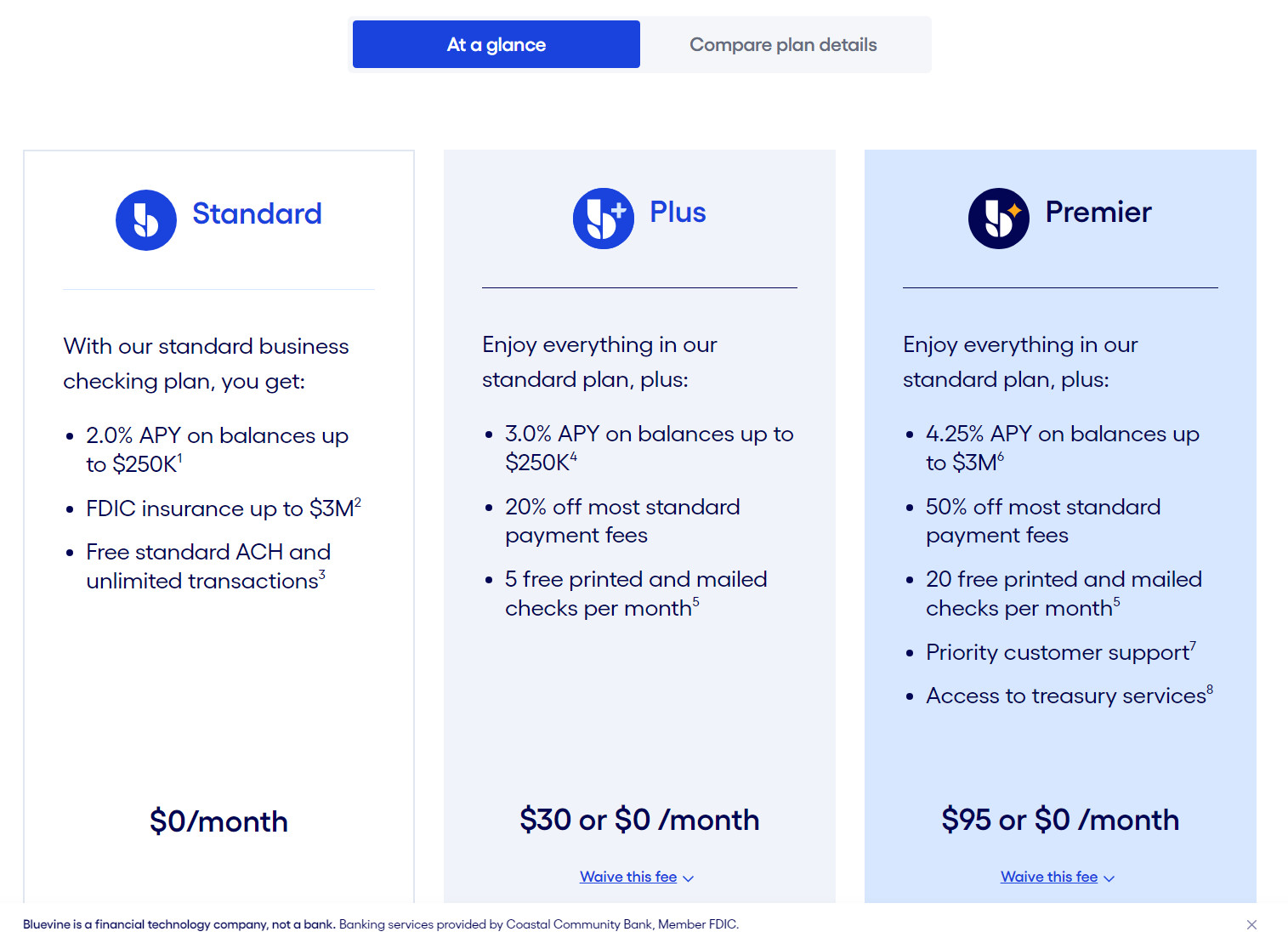

Bluevine charges a $2.50 fee for ATM transactions outside the MoneyPass network. Bluevine has introduced a Premier tier, which helps small business owners earn higher interest, access priority support, and reduce most payment fees by half. The Premier tier offers up to 4.25% APY, making it highly valuable for businesses with higher cash balances and frequent payments.

>> Join Bluevine for Innovative Business Banking! >>

Bluevine Business Checking Features

Bluevine offers just one account, but it’s packed with features. Bluevine Business Checking is an interest-bearing online business checking account that can earn a competitive 2.00% APY on balances up to $100,000. (Balances over $100,000 don’t earn interest.)

To qualify for the 2.00% APY, you need to spend $500 per month with your Bluevine Business Debit Mastercard or receive $2,500 per month in customer payments into your account via ACH, wire transfer, mobile check deposit, or directly from your merchant payment processor.

Vendor Services

Paying vendors is straightforward with Bluevine Business Checking. As a small business owner, you have several payment options, including ACH, wire transfer, and checks. You can make one-time bill payments or set up recurring automatic payments for convenience. With recurring payments, you know exactly when the payment will arrive at the payee, helping you avoid late payments.

Bluevine provides an online directory of 40,000 registered vendors, and you can add your own if needed. You can even pay by credit card through Bluevine’s online payment system.

Transactions

Although Bluevine has no physical branches, customers still have access to various transaction options through partnerships with other financial networks. Bluevine Business Checking includes a free Bluevine Business Debit Mastercard and two free checkbooks. Customers can access over 38,000 fee-free ATMs nationwide via the MoneyPass ATM network.

Small business owners can also make cash deposits through a partnership with Green Dot. You can deposit cash at over 90,000 participating retail locations across the U.S. Note that Green Dot charges a fee of up to $4.95 per cash deposit, and daily limits may apply.

Safety

Bluevine is a financial technology company, not a bank. Its banking services are provided through Coastal Community Bank, a Member FDIC. Coastal Community Bank ensures that all Bluevine Business Checking accounts are FDIC insured up to legal limits.

Mobile App

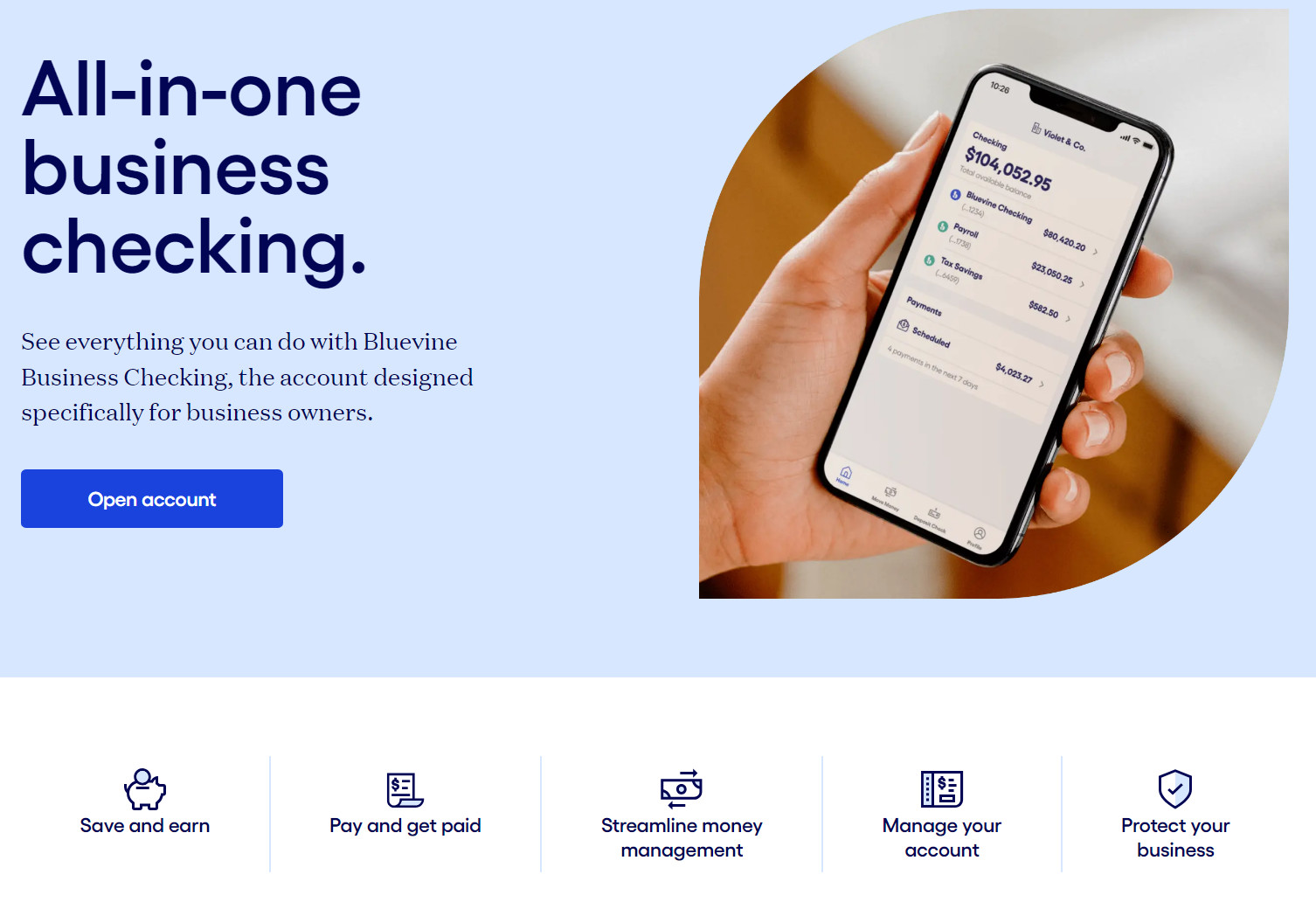

Bluevine customers can use the mobile app to make mobile check deposits and handle other daily transactions. This app enables small business owners to manage their finances and cash flow from anywhere.

Business Loans

In addition to checking, Bluevine offers business lines of credit up to $250,000 for larger purchases. Interest rates start as low as 4.8%, with the possibility of approval in just minutes.

To qualify, you need at least a 600 FICO score, $10,000 in monthly income, and a business incorporated or operating in a U.S. state for at least six months. After answering a few additional questions and providing access to current bank statements, Bluevine will decide on your loan. If you’re considering a bad credit business loan, explore the best available options.

>> Check Out the Best Features of the Bluevine >>

How to Open a Bluevine Business Checking Account

You can open a Bluevine business account online or through the Bluevine app. Bluevine business checking is available to business owners in all 50 states and the District of Columbia. To qualify, you must be at least 18 years old and a U.S. citizen or resident with a valid U.S. address (not a P.O. Box). Some types of businesses are restricted.

What You Need to Open an Account

You’ll need to provide basic details about yourself and your business. Required documentation varies by business type. Here's what you'll need:

- Personal Information: First and last name, home address, mobile phone number, date of birth, and Social Security number. This info is needed for anyone owning 25% or more of the company.

- Business Information: Business name, entity type, physical address, and phone number. You’ll also need to indicate your annual revenue, industry, and EIN or tax ID.

- Required Documentation: This varies by business type but may include articles of incorporation, certificate of formation, Doing Business As (DBA) documentation, and/or partnership agreements.

Bluevine typically reviews business checking applications within three business days. Once approved, you can activate your account, order your Bluevine debit card, and fund your account.

How to Earn Interest With Bluevine Business Checking

Bluevine business checking accounts earn 2.00% APY on balances up to $100,000, provided you meet one of these monthly requirements:

- Spend $500 with your Bluevine business debit card

- Receive $2,500 in customer payments into your Bluevine business checking account via ACH transfer, wire transfer, mobile check deposit, or directly from your payment processor.

>> Apply for a Bluevine Business Card >>

How to Access Your Money With the Bluevine Business Checking Account

When it comes to deposits and withdrawals, Bluevine Business Checking Account users have several options.

Deposit Options

Customers can deposit money into their Bluevine Business Checking Account in four main ways:

- Check deposit: Deposit checks through Bluevine's mobile app

- Wire transfer: Bluevine doesn't charge for incoming wires, but the sending institution might

- Account transfer: Link external bank accounts and transfer money into your Bluevine account

- Cash: Deposit cash at any retail location in Green Dot's network, though a fee applies for each deposit

Withdrawal Options

Bluevine Business Checking Account holders can withdraw money through various methods, including writing checks and wire transfers. They receive a business debit card for fee-free cash withdrawals at over 38,000 MoneyPass ATMs across the U.S. Out-of-network ATM withdrawals incur a surcharge. The Bluevine Payments feature allows direct payments to third parties.

Is Bluevine Trustworthy?

Bluevine has a clean reputation with no public controversies. It holds an A+ rating from the Better Business Bureau, indicating honest advertising, effective response to customer complaints, and transparent business practices.

However, a strong BBB rating doesn’t guarantee a flawless experience, so consider reading online reviews or asking friends and family about their experiences with Bluevine.

>> Open Your Bluevine Business Account Today! >>

Alternatives to Bluevine Business Checking

Novo

Novo is a top alternative to Bluevine, offering business checking accounts without many fees. Signing up is free, and there are minimal charges for using the service.

Unlike Bluevine, Novo charges a $27 fee for overdrafts. However, there's no requirement to maintain a certain balance, and ATM fees are refunded no matter where you use them.

Banking on the go is convenient with Novo's mobile app, available for both Android and iOS devices. However, Novo has a downside regarding cash since you can't deposit any physical money into your account.

Pros

- No monthly fees or minimum balance required

- User-friendly mobile app

- Refunds all ATM fees

Cons

- No cash deposits

- Fee for overdrawn accounts

- No savings accounts

Lili

Lili offers a unique feature with a free tax optimizer, helping prevent over or under-paying taxes. You can automatically set aside funds for tax time, eliminating surprises. The app also sorts personal and business expenses for easier write-offs.

There’s no fee or minimum amount required to sign up, and most services are free. However, there are deposit and withdrawal limits that may not suit larger businesses. Wire transfers aren’t possible with Lili.

If you're saving for a big purchase, Lili allows you to open a dedicated account. However, the free version doesn’t accrue any interest.

For 1% interest and additional features like overdraft protection, consider Lili Pro at $4.99 per month, which should cover its cost through interest alone. It’s also a good option for the LLC business bank accounts.

Pros

- Tax optimizer

- No minimum balance or monthly fees

- Savings buckets for future use

Cons

- Some features require a paid membership

- No APY in the free account

- No wire transfers

Axos

Axos offers a range of accounts beyond business checking, including business savings and personal accounts. Its basic business account has no sign-up or maintenance fees, and no minimum balance requirement. ATM fees are reimbursed no matter where you use them.

Business owners can also open a savings account, though interest rates are low at 0.20%. Even the premium savings account, requiring a $25,000 minimum deposit, doesn’t offer a higher APY.

Axos’ rates aren’t very competitive. CD rates are also 0.20%, providing little incentive to get a certificate. You can also set up personal savings and checking accounts through Axos.

Pros

- Several checking account options

- Unlimited domestic ATM fee reimbursements

- No monthly maintenance fees or balance requirements for basic checking

Cons

- Unattractive CD rates

- Low APY on business savings accounts

- Some accounts require high deposits

Bluevine Business Banking Review – Frequently Asked Questions

Here are some frequently asked questions about Bluevine Business Checking. Check these out to find answers to any lingering questions after reading this review.

Is Bluevine Legit?

Yes, Bluevine is a legitimate financial technology company. The Bluevine line of credit is issued by Celtic Bank, a Utah-chartered bank and FDIC member. Bluevine also offers small-business checking accounts through Coastal Community Bank. According to Crunchbase, Bluevine has raised $769.2 million in funding.

How Much Can I Withdraw From Bluevine?

The combined limit for all ATM cash withdrawals, cash back at POS, and OTC cash withdrawals is $2,000 per calendar day. ATM owners, merchants, and participating banks might impose their own fees and lower limits on cash withdrawals. Withdrawals at MoneyPass ATMs are surcharge-free.

Is Bluevine FDIC Insured?

Yes, Bluevine is FDIC insured through The Bancorp Bank (FDIC certificate No. 35444). Deposits are protected up to $250,000 per depositor, for each account ownership category, in the event of a bank failure.

Bottom Line on Bluevine Business Banking

Bluevine Business Checking is an excellent choice for small businesses due to its minimal fees and the ability to earn interest on balances up to $100,000. This account is unique among Select’s best business checking accounts as it offers interest on your balance.

>> Sign Up for Bluevine and Simplify Your Finances! >>