Have you ever dreamt about $3500 goggles for scuba diving? Apple has turned that dream into a reality. However, let’s get serious for a moment. Every presentation of Tim Cook’s company is a significant event that captures the world’s attention, including stock market participants, and the Vision Pro announcement is the leading news here. Let’s try to get why the new device was met with some caution and what we can expect from Apple stock.

Vision Pro is a cutting-edge headset that combines both AR and VR technologies. This means you can immerse yourself in a virtual reality game as a race car driver and seamlessly switch to an augmented reality video call with your colleagues. The device has been in development for many years but hasn’t been in the spotlight until now. Before the presentation, Visual Pro wasn’t a product for everyone – primarily known to Apple fans and experts. And after the presentation, the device’s status didn’t change – it seems to remain exclusive due to its high price point.

So, why are we discussing this in the context of the stock market? Firstly, because this device became a key highlight of the presentation – and every Apple presentation is of great significance for investors, Apple fans, and developers worldwide. If these stakeholders were impressed, it could have a significant positive impact on Apple’s stock prices. However, it appears that this might not be the case.

Of course, there are many factors affecting the stock markets. Some of them are sudden, but others are scheduled. To be a successful investor or trader, it’s essential to monitor them using the economic calendar, which provides data about all major economic events you need to know.

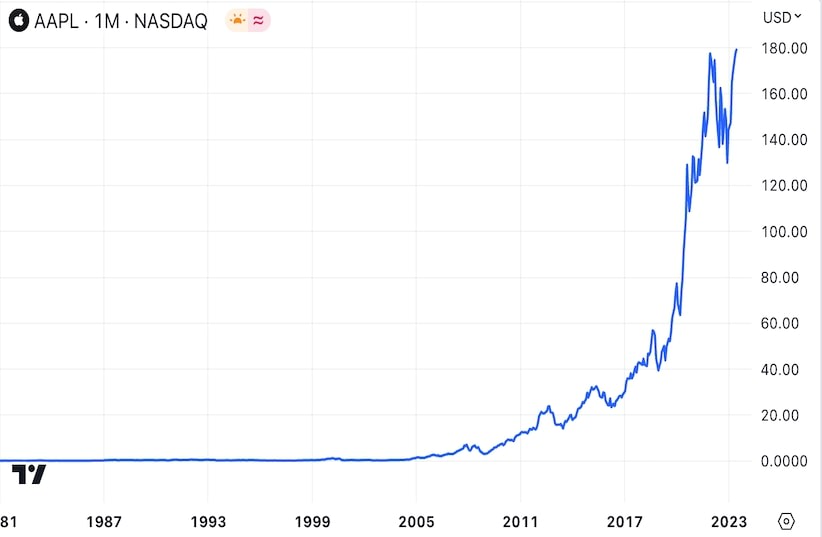

Social networks were full of rumors about the new Apple device. This fact alone allowed the company’s stock to reach its all-time high. Just take a look at the charts spanning over 40 years of Apple’s history.

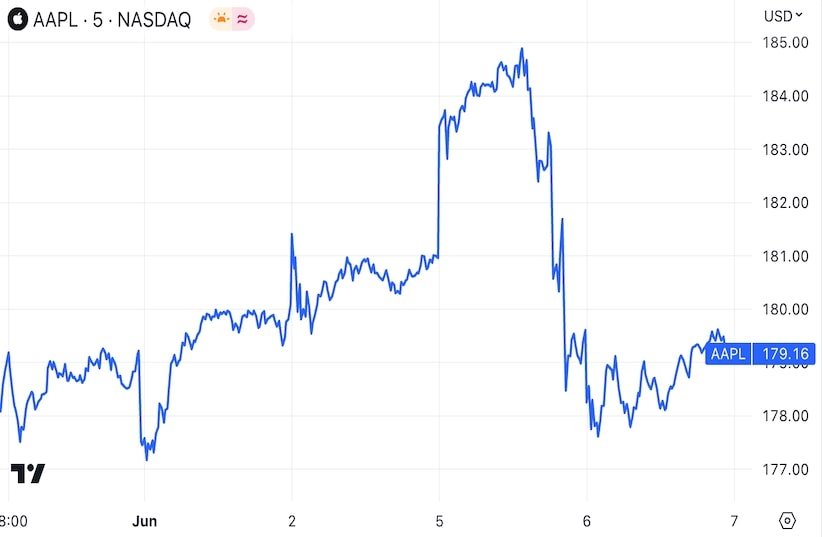

But if we augment the picture, we will see that the price of Apple stocks changed its direction after the official announcement, experiencing a drop of approximately $5.

In the chart above, you can see where we are right now. And the more important question is what’s next. Experts’ opinions are divided. On the one hand, Vision Pro may have disappointed customers who struggle to understand its purpose, potentially delaying its profitability for some time. But on the other hand, the headset opened the doors for a completely new direction, and in a few years time the Vision Pro 12 Max may become a beloved household item. Moreover, Apple is Apple – one of the industry’s biggest, most reliable, and profitable players.

Some experts, for example, from DA Davidson, lowered their target after the presentation, while others, like Wells Fargo and Wedbush, raised theirs. However, the consensus forecast suggests that Apple stocks might increase by approximately 4% over the next 12 months. While this may not sound overly impressive, it is a higher projection compared to many other companies.

It is important to remember that any investment decision requires careful consideration and thorough personal analysis before taking action.