Start-up lender Silicon Valley Bank Financial Group (SVB) became the largest bank to fail since the 2008 financial crisis on Friday in a sudden collapse that roiled global markets, leaving billions of dollars belonging to companies and investors stranded.

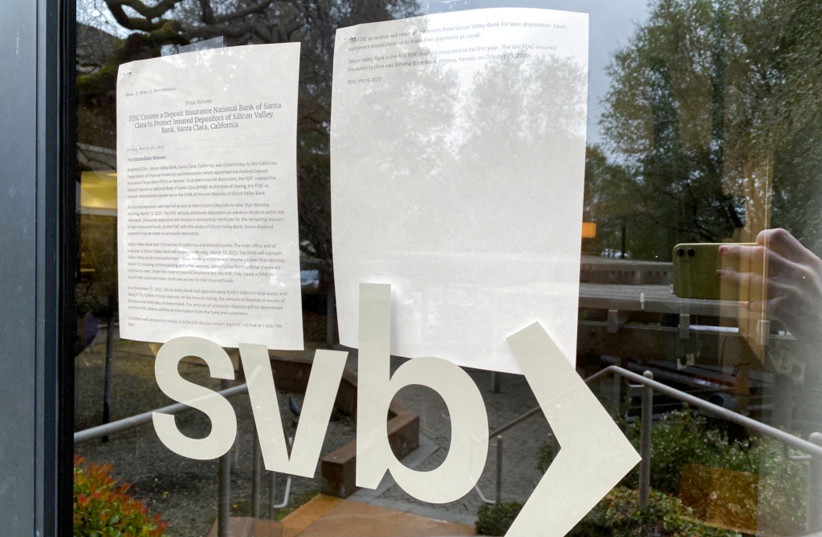

California banking regulators closed the bank on Friday and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver for later disposition of its assets.

"I am closely following the collapse of the American investment bank SVB, which is creating a deep crisis in the high-tech world."

Prime Minister Benjamin Netanyahu

Based in Santa Clara, the lender was ranked as the 16th biggest in the US at the end of last year, with about $209 billion in assets. Specifics of the tech-focused bank’s abrupt collapse were a jumble, but the Federal Reserve’s aggressive interest rate hikes in the last year, which had crimped financial conditions in the start-up space in which it was a notable player, seemed front and center.

As it tried to raise capital to offset fleeing deposits, the bank lost $1.8 billion on Treasury bonds whose values were torpedoed by the Fed rate hikes.

SVB’s failure is the largest since Washington Mutual went bust in 2008, a hallmark event that triggered a financial crisis that hobbled the economy for years. The 2008 crash prompted tougher rules in the United States and beyond.

Since then, regulators have imposed more stringent capital requirements for US banks aimed at ensuring individual bank collapses won’t harm the wider financial system and economy.

The main office and all branches of SVB will reopen on March 13 and all insured depositors will have full access to their insured deposits no later than Monday morning, the FDIC said.

But 89% of the bank’s $175 billion in deposits were uninsured as the end of 2022, according to the FDIC, and their fate remains to be determined.

The FDIC is racing to find another bank over the weekend that is willing to merge with SVB, according to people familiar with the matter who requested anonymity because the details are confidential. While the FDIC hopes to put together such a merger by Monday to safeguard unsecured deposits, no deal is certain, the sources added.

An FDIC spokesperson did not immediately respond to a request for comment.

Israel responds to bank crash

Prime Minister Benjamin Netanyahu responded to the SVB crash, saying, “I am closely following the collapse of the American investment bank SVB, which is creating a deep crisis in the hi-tech world. I held talks from Rome with hi-tech officials in Israel, and upon my return to Israel I will discuss the extent of the crisis with the ministers of finance and economy and the governor of the Bank of Israel.”

He continued, if necessary, out of responsibility for the companies and employees of hi-tech in Israel, we will take steps that will help Israeli companies, whose operations are centered in Israel, to overcome the cash flow crisis that has arisen for them due to the upheaval. Israel’s economy is strong and stable, and this is again reflected in this crisis as well.”

Finance Minister Bezalel Smotrich decided to establish dedicated team to monitor the issue of the SVB collapse, he tweeted on Saturday night.

"The team, led by the Finance Ministry director-general, Shlomi Heizler, will be composed of representatives of the ministry, the Bank of Israel, the Securities Authority and the Innovation Authority.

"The team will be in contact with the local hi-tech industry, foundations and financial institutions in Israel and the US for the purpose of receiving data and analyzing the possible impact on the Israeli economy and, as necessary, for formulating a response to Israeli companies," he continued.

Buyers sought

Separately, SVB Financial, the parent company of Silicon Valley Bank, is working with investment bank Centerview Partners and law firm Sullivan & Cromwell to find buyers for its other assets, which include investment bank SVB Securities, wealth manager Boston Private and equity research firm MoffettNathanson, the sources said. These assets could attract competitors and private equity firms, the sources added.

It’s unclear if any buyer will step up to buy these assets without SVB Financial having filed for bankruptcy first. Credit ratings agency S&P Global Ratings said on Friday it expected SVB Financial to enter bankruptcy because of its liabilities.

Companies such as video game maker Roblox Corp and streaming device maker Roku said they had hundreds of millions of dollars in deposits at the bank. Roku said its deposits with SVB were largely uninsured, sending its shares down 10% in extended trading.

Technology workers whose paychecks relied on the bank were also worried about getting their wages on Friday. An SVB branch in San Francisco showed a note taped to the door telling clients to call a toll-free telephone number.

SVB Financial CEO Greg Becker sent a video message to employees on Friday acknowledging the “incredibly difficult” 48 hours leading up to the collapse of the bank.

The problems at SVB underscore how a campaign by the US Federal Reserve and other central banks to fight inflation by ending the era of cheap money is exposing vulnerabilities in the market. The worries walloped the banking sector.

US banks have lost over $100 billion in stock market value over the past two days, with European banks losing around another $50 billion in value, according to a Reuters calculation.

US lenders First Republic Bank and Western Alliance said on Friday their liquidity and deposits remained strong, aiming to calm investors as their shares fell. Others such as Germany’s Commerzbank issued unusual statements to reassure investors.

More pain

Some analysts forecast more pain for the sector as the episode spread concern about hidden risks in the banking sector and its vulnerability to the rising cost of money.

“There could be a bloodbath next week as... short sellers are out there and they are going to attack every single bank, especially the smaller ones,” said Christopher Whalen, chairman of Whalen Global Advisors.

US Treasury Secretary Janet Yellen met banking regulators on Friday and expressed “full confidence” in their abilities to respond to the situation, Treasury said.

The White House said on Friday it had faith and confidence in US financial regulators, when asked about the failure of SVB.

The genesis of SVB’s collapse lies in a rising interest rate environment. As higher interest rates caused the market for initial public offerings to shut down for many start-ups and made private fundraising more costly, some SVB clients started pulling money out.

To fund the redemptions, SVB sold a $21 billion bond portfolio consisting mostly of US Treasuries on Wednesday, and said it would sell $2.25 billion in common equity and preferred convertible stock to fill its funding hole.

By Friday, the collapsing stock price had made its capital raise untenable and sources said the bank tried to look at other options, including a sale, until regulators stepped in and shut the bank down.

The last FDIC-insured institution to close was Almena State Bank in Kansas, on October 23, 2020.