The Israeli automobile market ended the first half of 2023 with a passing mark only. Although 174,000 directly imported vehicles were delivered between January and June, a respectable total and representing a 10% rise in comparison with the first half of 2022, the market was chiefly closing gaps in supply that arose last year.

Were it not for this catch-up process, particularly by the leasing companies, the delivery figures for the first half would presumably have been much lower, and perhaps even below those for the first half of last year, mainly because of the end of cheap credit, which in the past few years has been one of the main drivers of the market.

The ray of light in the first half year was the electric vehicle (EV) segment. Nearly 29,000 EVs were delivered in the period, representing an increase of 219% over the corresponding period of 2022, and surpassing the 27,600 EVs delivered in the whole of last year. EVs almost tripled their share of the Israeli new vehicles market, to 16.3% of deliveries. Nevertheless, this segment is still far from being stable, and faces several challenges – and perhaps opportunities as well.

Dominant brands and emerging players in the Israeli EV market

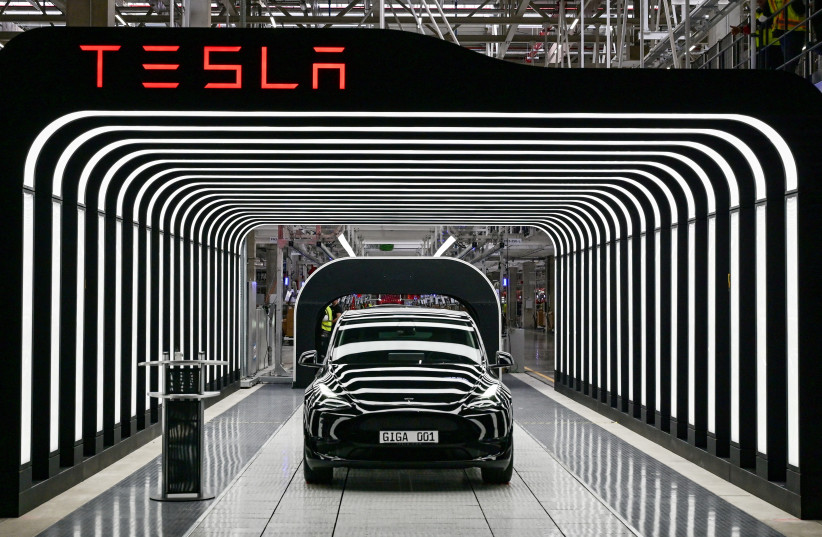

The EV segment looks competitive, and only last month we learned that three new Chinese EV brands were on their way to Israel. The delivery statistics, however, show a concentrated market, similar to the vehicle market in general, with 73% of the EV deliveries in the first half coming from four leading brands: Geely, BYD, Tesla, and Hyundai.

The concentration largely stems from the fact that the segment is still young, and the model ranges of the various brands are not homogeneous. Some brands focus solely on the luxury end of the market, where market penetration in Israel is still very low. Others are still limited by their manufacturers’ supply volumes, or suffer from standards restrictions. There are also new players that only entered the market in the second quarter and have not yet managed to make an impression.

The bottom line, though, is that the segment is dominated by brands that came in early and that offer products well adapted to the Israeli market, the backing of a large vehicle manufacturer, and a comprehensive sales network of large importers. The only exception among the group at the top is Tesla, which made a respectable comeback in the first half, mainly thanks to significant price cuts, but which still lags behind when it comes to building a marketing and sales support network.

Challenges and opportunities for the Israeli EV market

After two years in the market, it still lacks a permanent showroom and a nationwide independent service network. At any rate, the success of the major brands represents a considerable barrier to entry for late comers.

Another conclusion that can be drawn from the half-year EV sales figures is that, despite the impressive growth and substantial market share, the segment’s true potential is far from being exhausted. The average list price of an EV in Israel in the first half-year (excluding discounted prices for leasing companies) was NIS 165,000. This means that even “popular” models sold in Israel are still aimed at a relatively well-off clientele.

Such models still barely penetrate their natural market, that is, people who are particularly sensitive to the costs of running a car, such as fuel costs. A contributing factor here is high interest rates on vehicle financing, which makes things difficult for those with a low budget to migrate upwards to the EV segment.

There is no doubt, however, that if some EV brand were to pick up the gauntlet and sell a family EV in Israel for NIS 140,000-145,000, with a range of over 400 kilometers, which is the psychological threshold for people switching from gasoline cars to electric, such a move could expand the EV segment considerably.

Market dynamics and potential disruptors to the Israeli EV market

For the time being, this is not happening, not with MG, which recently launched its MG4 model, and not with Geely, which has launched its updated Geometry model. Both brands are keeping the long-range versions of these models close to the average price for the segment. The official reason for this is the weakness of the shekel, but it is almost certainly also caused by the desire to maintain a wide margin for discounts to the leasing companies.

All the same, there is at least one potential game changer, namely BYD’s Dolphin, which will be launched in Israel shortly. This model recently reached the European market with a spacious passenger compartment (a 2.7 meter wheelbase), and strong engine, generous accessories as is the norm with the Chinese brands, and, most importantly, a range of 427 kilometers per the WLTP standard.

The price has yet to be published, but it’s fairly safe to bet on a range of NIS 140,000-145,000, because BYD has three reasons to give the new car an aggressive penetration price in the Israeli market. First of all, Israel has become BYD’s flagship market for exports and sales. The brand’s consistent leadership of the Israeli sales table is a marketing asset that it exploits well back in China.

Incidentally, its sales give the brand’s importer, Shlomo Motors, an unusually strong position vis-a-vis the manufacturer, which it will probably take advantage of to gain flexibility over pricing.