The fallout from the collapse of Silicon Valley Bank is beginning to spread around the world.

Startup founders in California’s Bay Area are panicking about access to money and paying employees. Fears of contagion have reached Canada, where the bank’s loan book has doubled in the past year. SVB’s unit in the UK is set to be declared insolvent, has already ceased trading and is no longer taking new customers. On Saturday, the leaders of roughly 180 tech companies sent a letter calling on UK Chancellor Jeremy Hunt to intervene.

“The loss of deposits has the potential to cripple the sector and set the ecosystem back 20 years,” they said in the letter seen by Bloomberg. “Many businesses will be sent into involuntary liquidation overnight.”

This is just the beginning. SVB had branches in China, Denmark, Germany, India, Israel and Sweden, too. Founders are warning that the bank’s failure could wipe out startups around the world without government intervention. SVB’s joint venture in China, SPD Silicon Valley Bank Co., was seeking to calm local clients overnight by reminding them that operations have been independent and stable.

“This crisis will start on Monday and so we call on you to prevent it now,” UK startup founders and chief executive officers said in the letter to Hunt. The companies listed in the letter include Uncapped, Apian, Pockit and Pivotal Earth.

Hunt spoke with the governor of the Bank of England about the situation on Saturday morning, and the economic secretary to the Treasury was holding a roundtable with affected firms later in the day, the Treasury said.

Underscoring the challenge governments face in getting a handle of the full extent of the fallout: The UK Treasury has begun canvassing startups, asking how much they have on deposit, their approximate cash burn and their access to banking facilities at SVB and beyond, two people familiar with the matter said, asking not to be identified because the information isn’t public. Treasury declined to comment on the survey.

“If there is no intervention, it could really wipe out a generation of entrepreneurial companies.”

Jack O’Meara

Founders were anxiously awaiting the outcome of the roundtable and any information about how their deposits at the bank would be handled. Toby Mather, CEO of education software startup Lingumi, has 85% of his company’s cash in SVB. He tried to transfer his accounts from SVB using an iPhone app, but as of Saturday evening, he wasn’t sure whether that worked. “This is life or death for us,” he said. “These things seemed so mundane before.”

Jack O’Meara, founder of the London genomics startup Ochre Bio, spent the weekend trying, unsuccessfully, to move deposits out of SVB. “If there is no intervention,” he said, “it could really wipe out a generation of entrepreneurial companies.”

US Rep. Ro Khanna, D-Calif., held a town hall late Friday that was attended by more than 600 people including startup founders, tech leaders and SVB employees. It went on for more than 2.5 hours with the primary focus on small businesses trying to make payroll across the nation come Monday.

Customers try to access money, with little success

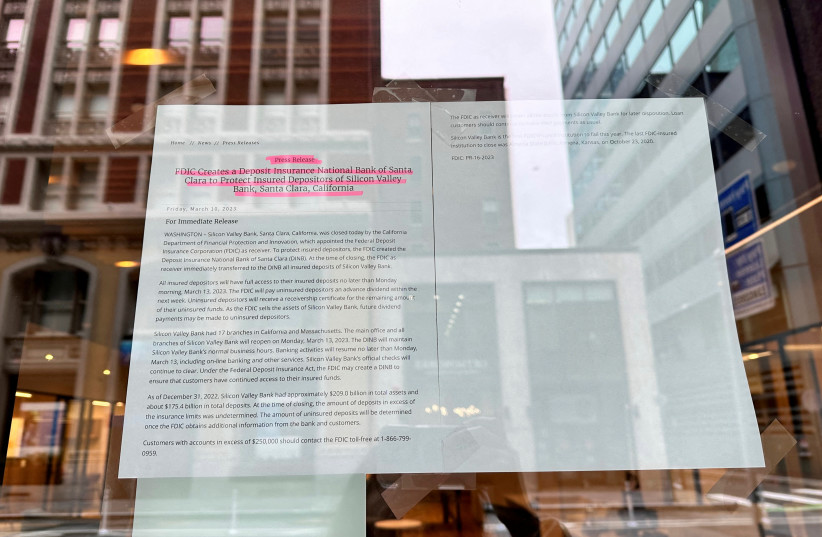

SVB customers in California, many of them startup founders, stood outside of the bank’s branch on Silicon Valley’s famed Sand Hill Road in the cold and rain on Friday, knocking on the locked glass doors and trying to get representatives of the Federal Deposit Insurance Corporation to answer their questions.

A drones startup founder there said a withdrawal she made on Thursday hadn’t gone through and that she was concerned about making payroll for her 12 full-time employees. She had tried calling the FDIC multiple times, “but the number doesn’t answer,” she said.

Another customer remarked that he should have brought a bottle of whiskey to pass around as they waited. In trying to get more information from an FDIC representative, he said, “Put yourself in our shoes.” The representative apologized before closing the glass door once again.

Some in the VC and startup world are trying to come up with temporary fixes. Uncapped, a UK financial tech startup that lends to other startups, said it’s launching an emergency funding program to help companies meet payroll and other obligations, as well as longer-term bridge loans to help with working capital.

Alexander Fitzgerald, founder of broadband startup Cuckoo and a former Treasury official, noted that the finances of British startups are already stretched due to a slowdown in venture capital funding market. “British startups need the Treasury to step in fast,” he said.

In Canada, SVB Financial Group’s unit in the country reported $435 million Canadian dollars ($314 million) in secured loans last year, double the $212 million Canadian dollars a year earlier, regulatory filings show. Its customers include e-commerce software provider Shopify Inc. and pharmaceutical company HLS Therapeutics Inc., according to a previous statement by the bank.

Toronto-based advertising-tech firm AcuityAds Holdings Inc. revealed on Saturday it had $55 million in deposits at SVB, amounting to more than 90% of its cash. The firm had halted trading of its stock Friday after a 14% slump, citing the “unfolding situation” with Silicon Valley Bank.